- U.S. Home Price Index had the largest annual appreciation since March 2014

- HPI Forecast predicts home price growth to slow through November 2021

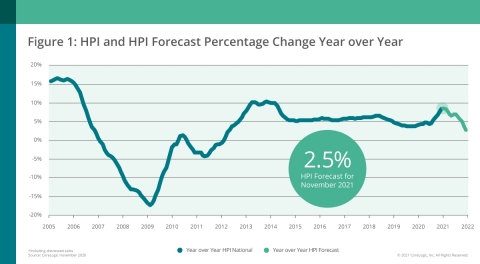

IRVINE, Calif. — (BUSINESS WIRE) — January 5, 2021 — CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for November 2020. Nationally, home prices increased 8.2% in November 2020, compared with November 2019, marking the largest annual appreciation since March 2014. On a month-over-month basis, home prices increased by 1.1% compared to October 2020.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210105005249/en/

CoreLogic National Home Price Change and Forecast; November 2020 (Graphic: Business Wire)

Home price growth remained consistently elevated throughout 2020. Home sales for the year are expected to register above 2019 levels. Meanwhile, the availability of for-sale homes has dwindled as demand increased and coronavirus (COVID-19) outbreaks continued across the country, which delayed some sellers from putting their homes on the market.

While the pandemic left many in positions of financial insecurity, those who maintained employment and income stability are also incentivized to buy given the record-low mortgage rates available; this is increasing buyer demand while for-sale inventory is in short supply. The continued rise in home prices increases down payment requirements and exacerbates the housing market’s affordability issues, leaving lower-income families in rentals and priced-out of the home-purchase market. Slowing buyer demand, coupled with more supply in the coming year, is reflected in the CoreLogic HPI Forecast, which shows annual home price growth slowing from 7.5% during the first quarter of 2021 to 2.5% by November 2021. However, possible stimulus actions could help spur home buyer demand among low- and middle-income families and support stronger home price growth.

“The housing market performed remarkably well in 2020 despite the volatile economic state,” said Frank Martell, president and CEO of CoreLogic. “While we can expect to see lingering effects of COVID-19 resurgences and subsequent shutdowns in the early months of 2021, vaccine distributions and stimulus actions should revitalize economic activity and keep home purchase demand and home price growth strong.”

“The demographic tailwind has arrived as Generation X and millennials drive housing demand,” said Dr. Frank Nothaft, chief economist at CoreLogic. “Lower-priced home values increased about one and a half times faster than higher-priced home values in November, as first-time buyers tend to seek out homes within the lower price ranges.”

Despite the rapid acceleration of national home price growth, local markets continue to vary. For instance, in Phoenix, where there is a severe shortage of for-sale homes, prices continued to surge, increasing 12.6% year over year in November. Meanwhile, the New York-Jersey City-White Plains metro recorded a smaller-than-average annual increase of 3.2%, as residents continue to seek out more space in less densely populated areas. At the state level, Idaho, Maine and Indiana experienced the strongest price growth in November, up 15.7%, 15.4% and 13.6%, respectively.

The HPI Forecast also reveals the disparity in home price growth across metros. In markets like Houston, which was hit hard by the collapse of the oil industry and the recent hurricane season, home prices are expected to decline 1.4% by November 2021. Conversely, in San Diego, home prices are forecasted to increase 8.3% over the next 12 months as low inventory continues to increase prices.

The CoreLogic Market Risk Indicator (MRI), a monthly update of the overall health of housing markets across the country, predicts that metros such as Miami; Lake Charles, Louisiana and Prescott, Arizona, are at the greatest risk (above 70%) of a decline in home prices over the next 12 months, while Brownsville-Harlingen, Texas, and Gulfport-Biloxi-Pascagoula, Mississippi, are at moderate risk (50%-70%) of a decrease.

The next CoreLogic HPI press release, featuring December 2020 data, will be issued on February 2, 2021 at 8:00 a.m. ET.

Methodology

The CoreLogic HPI™ is built on industry-leading public record, servicing and securities real-estate databases and incorporates more than 40 years of repeat-sales transactions for analyzing home price trends. Generally released on the first Tuesday of each month with an average five-week lag, the CoreLogic HPI is designed to provide an early indication of home price trends by market segment and for the “Single-Family Combined” tier, representing the most comprehensive set of properties, including all sales for single-family attached and single-family detached properties. The indices are fully revised with each release and employ techniques to signal turning points sooner. The CoreLogic HPI provides measures for multiple market segments, referred to as tiers, based on property type, price, time between sales, loan type (conforming vs. non-conforming) and distressed sales. Broad national coverage is available from the national level down to ZIP Code, including non-disclosure states.

CoreLogic HPI Forecasts™ are based on a two-stage, error-correction econometric model that combines the equilibrium home price—as a function of real disposable income per capita—with short-run fluctuations caused by market momentum, mean-reversion, and exogenous economic shocks like changes in the unemployment rate. With a 30-year forecast horizon, CoreLogic HPI Forecasts project CoreLogic HPI levels for two tiers — “Single-Family Combined” (both attached and detached) and “Single-Family Combined Excluding Distressed Sales.” As a companion to the CoreLogic HPI Forecasts, Stress-Testing Scenarios align with Comprehensive Capital Analysis and Review (CCAR) national scenarios to project five years of home prices under baseline, adverse and severely adverse scenarios at state, metropolitan areas and ZIP Code levels. The forecast accuracy represents a 95% statistical confidence interval with a +/- 2% margin of error for the index.

About Market Risk Indicator

Market Risk Indicators are a subscription-based analytics solution that provide monthly updates on the overall “health” of housing markets across the country. CoreLogic data scientists combine world-class analytics with detailed economic and housing data to help determine the likelihood of a housing bubble burst in 392 major metros and all 50 states. Market Risk Indicators is a multi-phase regression model that provides a probability score (from 1 to 100) on the likelihood of two scenarios per metro: a >10% price reduction and a ≤ 10% price reduction. The higher the score, the higher the risk of a price reduction.

About the Market Condition Indicators

As part of the CoreLogic HPI and HPI Forecasts offerings, Market Condition Indicators are available for all metropolitan areas and identify individual markets as “overvalued”, “at value”, or “undervalued.” These indicators are derived from the long-term fundamental values, which are a function of real disposable income per capita. Markets are labeled as overvalued if the current home price indexes exceed their long-term values by greater than 10%, and undervalued where the long-term values exceed the index levels by greater than 10%.

Source: CoreLogic

The data provided are for use only by the primary recipient or the primary recipient's publication or broadcast. This data may not be resold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data are illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact Valerie Sheets at newsmedia@corelogic.com. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. The data are compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic (NYSE:

CLGX), the leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, buy and protect their homes. For more information, please visit

www.corelogic.com .