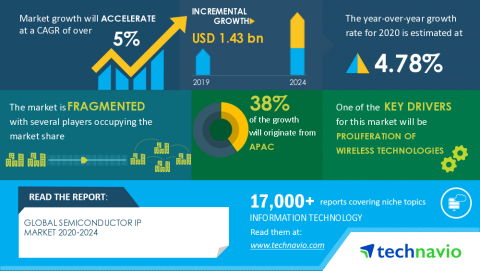

LONDON — (BUSINESS WIRE) — June 12, 2020 — Technavio has been monitoring the semiconductor IP market and it is poised to grow by USD 1.43 billion during 2020-2024, progressing at a CAGR of over 5% during the forecast period. The report offers an up-to-date analysis regarding the current market scenario, latest trends and drivers, and the overall market environment.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200612005197/en/

Technavio has announced its latest market research report titled Global Semiconductor IP Market 2020-2024 (Graphic: Business Wire)

Technavio suggests three forecast scenarios (optimistic, probable, and pessimistic) considering the impact of COVID-19. Request for Technavio's latest reports on directly and indirectly impacted markets. Market estimates include pre- and post-COVID-19 impact on the Semiconductor IP Market Download free sample report

The market is fragmented, and the degree of fragmentation will accelerate during the forecast period. Arm Ltd., Cadence Design Systems Inc., CEVA Inc., eMemory Technology Inc., Imagination Technologies Ltd., Lattice Semiconductor Corp., Rambus Inc., Siemens AG, Synopsys Inc., and Xilinx Inc. are some of the major market participants. To make the most of the opportunities, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

Buy 1 Technavio report and get the second for 50% off. Buy 2 Technavio reports and get the third for free.

View market snapshot before purchasing

The proliferation of wireless technologies has been instrumental in driving the growth of the market.

Technavio's custom research reports offer detailed insights on the impact of COVID-19 at an industry level, a regional level, and subsequent supply chain operations. This customized report will also help clients keep up with new product launches in direct & indirect COVID-19 related markets, upcoming vaccines and pipeline analysis, and significant developments in vendor operations and government regulations. https://www.technavio.com/report/report/semiconductor-IP-market-industry-analysis

Semiconductor IP Market 2020-2024: Segmentation

Semiconductor IP Market is segmented as below:

-

Application

- Mobile Computing Devices

- Consumer Electronics

- Automotive

- Industrial Automation

- Others

-

Form Factor

- Processor IP

- Physical IP

- Digital IP

-

End-user

- Fabless Semiconductor

- IDMs

- Foundries

-

Geographic Landscape

- APAC

- Europe

- MEA

- North America

- South America

To learn more about the global trends impacting the future of market research, download a free sample: https://www.technavio.com/talk-to-us?report=IRTNTR40521

Semiconductor IP Market 2020-2024: Scope

Technavio presents a detailed picture of the market by the way of study, synthesis, and summation of data from multiple sources. The semiconductor IP market report covers the following areas:

- Semiconductor IP Market Size

- Semiconductor IP Market Trends

- Semiconductor IP Market Analysis

This study identifies complex chip designs and the use of multi-core technologies as one of the prime reasons driving the semiconductor IP market growth during the next few years.

Register for a free trial today and gain instant access to 17,000+ market research reports.

Technavio's SUBSCRIPTION platform

Semiconductor IP Market 2020-2024: Key Highlights

- CAGR of the market during the forecast period 2020-2024

- Detailed information on factors that will assist semiconductor IP market growth during the next five years

- Estimation of the semiconductor IP market size and its contribution to the parent market

- Predictions on upcoming trends and changes in consumer behavior

- The growth of the semiconductor IP market

- Analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of semiconductor IP market vendors

Table of Contents:

Executive Summary

- Market Overview

Market Landscape

- Market ecosystem

- Value chain analysis

Market Sizing

- Market definition

- Market segment analysis

- Market size 2019

- Market outlook: Forecast for 2019 - 2024

Five Forces Analysis

- Five Forces Summary

- Bargaining power of buyers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Threat of rivalry

- Market condition

Market Segmentation by Application

- Market segments

- Comparison by Application placement

- Mobile computing devices - Market size and forecast 2019-2024

- Consumer electronics - Market size and forecast 2019-2024

- Automotive - Market size and forecast 2019-2024

- Industrial automation - Market size and forecast 2019-2024

- Others - Market size and forecast 2019-2024

- Market opportunity by Application

Market Segmentation by End-user

- Market segments

- Comparison by End-user placement

- Fabless semiconductor companies - Market size and forecast 2019-2024

- IDMs - Market size and forecast 2019-2024

- Foundries - Market size and forecast 2019-2024

- Market opportunity by End-user

Market Segmentation by Form Factor

- Market segments

- Comparison by Form Factor placement

- Processor IP - Market size and forecast 2019-2024

- Physical IP - Market size and forecast 2019-2024

- Digital IP - Market size and forecast 2019-2024

- Market opportunity by Form Factor

Customer Landscape

- Overview

Geographic Landscape

- Geographic segmentation

- Geographic comparison

- North America - Market size and forecast 2019-2024

- APAC - Market size and forecast 2019-2024

- Europe - Market size and forecast 2019-2024

- South America - Market size and forecast 2019-2024

- MEA - Market size and forecast 2019-2024

- Key leading countries

- Market opportunity by geography

Drivers, Challenges, and Trends

- Market drivers

- Volume driver - Demand led growth

- Volume driver - Supply led growth

- Volume driver - External factors

- Volume driver - Demand shift in adjacent markets

- Price driver - Inflation

- Price driver - Shift from lower to higher-priced units

- Market challenges

- Market trends

Vendor Landscape

- Overview

- Vendor landscape

- Landscape disruption

Vendor Analysis

- Vendors covered

- Market positioning of vendors

- Arm Ltd.

- Cadence Design Systems, Inc.

- CEVA Inc.

- eMemory Technology Inc.

- Imagination Technologies Ltd.

- Lattice Semiconductor Corp.

- Rambus Inc.

- Siemens AG

- Synopsys Inc.

- Xilinx Inc.