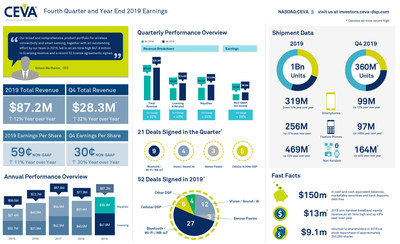

- Record quarterly total revenue of $28.3 million, up 32% year-over-year

MOUNTAIN VIEW, Calif., Feb. 18, 2020 — (PRNewswire) — CEVA, Inc. (NASDAQ: CEVA), the leading licensor of wireless connectivity and smart sensing technologies, today announced its financial results for the fourth quarter and year ended December 31, 2019.

Total revenue for the fourth quarter of 2019 was a record high $28.3 million, an increase of 32%, when compared to $21.4 million reported for the fourth quarter of 2018. Fourth quarter 2019 licensing and related revenue was a record high $14.8 million, an increase of 40%, when compared to $10.5 million reported for the same quarter a year ago. Royalty revenue for the fourth quarter of 2019 was a record high $13.5 million, an increase of 24%, when compared to $10.9 million reported for the fourth quarter of 2018.

Gideon Wertheizer, Chief Executive Officer of CEVA, stated: "We are extremely pleased with our outstanding fourth quarter, as we set record highs in licensing and royalties. Our organization showed exceptional performance in executing twenty-one licensing agreements for a record revenue of $14.8 million, including a strategic agreement with a very large smartphone OEM for its in-house cellular modem development. Our record royalty revenue quarter of $13.5 million was driven by new handset launches and seasonal strength together with new production ramps of our non-handset baseband technologies."

Mr. Wertheizer continued: "Our broad and comprehensive product portfolio for wireless connectivity and smart sensing, together with an outstanding effort by our team in 2019, led to an all-time high $47.9 million in licensing revenue and a record fifty-two license agreements signed. Our royalty business grew 5% to $39.3 million, driven by rapid expansion in the non-handset baseband category with 49% year-over-year growth to $13 million, offset by overall maturity in the handset space."

During the quarter, CEVA completed twenty-one license agreements. Six of the agreements were for smart sensing products and fifteen for connectivity products. Nineteen of the licensing agreements signed during the quarter were for non-handset baseband applications and ten were with first-time customers of CEVA. Customers' target applications include baseband processing for 5G base stations, smartphones and cellular IoT devices, AI and computer vision for consumer electronics, surveillance and automotive, audio and Bluetooth connectivity for true wireless stereo earbuds, sensor fusion for smart TV control, laptops and PC peripherals, and Bluetooth and Wi-Fi connectivity for a wide variety of IoT devices. Geographically, ten of the deals signed were in China, five were in the U.S., two in Europe and four were in the APAC region, including Japan.

GAAP net income for the fourth quarter of 2019 increased 33% to $3.1 million, compared to $2.3 million reported for the same period in 2018. GAAP diluted earnings per share for the fourth quarter of 2019 increased 40%, to $0.14 from $0.10 a year ago.

Non-GAAP net income and diluted earnings per share for the fourth quarter of 2019 were $6.8 million and $0.30, respectively, representing an increase of 29% and 30% respectively, over the $5.2 million and $0.23 reported for the fourth quarter of 2018. Non-GAAP net income and diluted earnings per share for the fourth quarter of 2019 excluded: (a) equity-based compensation expense, net of taxes, of $2.8 million, and (b) the impact of the amortization of acquired intangibles and other assets of $0.9 million associated with the acquisitions of RivieraWaves and the Hillcrest Labs business, and investments in NB-IoT and Immervision technologies. Net income and diluted earnings per share for the fourth quarter of 2018 excluded: (i) equity-based compensation expense, net of taxes, of $2.0 million, and (ii) the impact of the amortization of acquired intangibles of $0.3 million associated with the acquisition of RivieraWaves and the investment NB-IoT technologies, and (iii) revaluation of investment in other company, net of taxes, of $0.7 million.

Full Year 2019 Review

Total revenue for 2019 was $87.2 million, an increase of 12%, when compared to $77.9 million reported for 2018. Licensing and related revenue for 2019 was $47.9 million, an increase of 18%, when compared to $40.4 million reported for 2018. Royalty revenue for 2019 was $39.3 million, representing an increase of 5%, as compared to $37.4 million reported for 2018.

U.S. GAAP net income diluted earnings per share for 2019 were $0.0 million and $0.00, respectively, compared to U.S GAAP net income and diluted net income $0.6 million and $0.03, respectively reported for 2018.

Non-GAAP net income and diluted earnings per share for 2019 were $13.4 million and $0.59, respectively, representing an increase of 10% and 11% respectively, over $12.1 million and $0.53 reported for 2018, respectively. Non-GAAP net income and diluted earnings per share for 2019 excluded (a) equity-based compensation expense, net of taxes, of $10.1 million , (b) the impact of the amortization of acquired intangibles of $2.3 million associated with the acquisitions of RivieraWaves and the Hillcrest Labs business, and the investments in NB-IoT and Immervision technologies, and (c) deal expenses and write-off of an acquired lease associated with the Hillcrest Labs transaction of $0.8 million . Non-GAAP net income and diluted earnings per share for 2018 excluded (a) equity-based compensation expense, net of taxes, of $9.7 million , and (b) the impact of the amortization of acquired intangibles of $1.2 million associated with the acquisition of RivieraWaves and the investment NB-IoT technologies, and (c) revaluation of investment in other company, net of taxes, of $0.7 million.