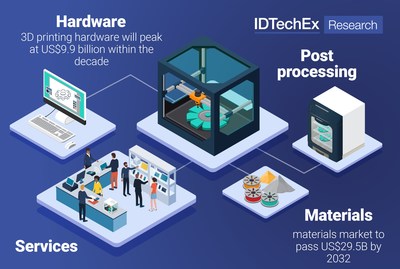

However, with so much focus being put on 3D printers, it can be easy to lose sight of the many other important sectors that make 3D printing, especially industrial additive manufacturing, possible. It takes an entire ecosystem, including materials, software, post-processing, quality assurance, services, specialized training, and more, for 3D printing to be utilized in high-value industries and applications. It is the maturation of all aspects of AM that is driving its increased adoption by end-users.

In this article, IDTechEx will introduce some important elements of the AM ecosystem and discuss developments in these fields to see how other parts of the 3D printing industry are changing.

Materials

Historically, 3D-printed parts have struggled to compete with conventionally manufactured parts (i.e. machined parts, injection-molded parts, etc.) in part because of their poorer mechanical and materials performance. Therefore, significant effort is being expended by 3D printing companies (including materials suppliers like BASF and Arkema) to address these shortcomings from a materials point-of-view. One of the most popular approaches to improve performance is reinforcements like carbon and glass fibers; a more advanced category of reinforcements is nanocarbon fillers like graphene and carbon nanotubes, which are beginning to be incorporated into commercial 3D printing materials. Another approach is making high-performance but difficult to process materials like high-temperature thermoplastics and foams more printable. Important to recognize is that different printing technologies require different improvements in materials to optimize overall performance. Further discussion on the developments in the 3D printing materials market can be found in IDTechEx's report " 3D Printing and Additive Manufacturing 2023-2033: Technology and Market Outlook".

Post-Processing

Post-processing refers to the step(s) taken after 3D printing to finish manufacturing a single part. It is often the last or second-to-last step in the additive manufacturing process (where the final step may be quality assurance). Post-processing for AM includes a collection of techniques; some are specific to AM (i.e. support removal, depowdering), while others are used in other manufacturing processes (i.e. surface finishing, metal annealing treatments). Some post-processing techniques are required after printing, while others are optional but often done to improve certain aspects of the printed part (i.e. mechanical performance, appearance, etc.).

As 3D printing is increasingly used for medium-to-high volume parts, post-processing is becoming increasingly essential to make printed parts suitable for end-use applications. To address this need, several specialized AM post-processing companies, like DyeMansion, AMT, and PostProcess Technologies, are producing post-processing equipment capable of handling higher volumes of parts. Such machines are made to handle high numbers of parts and to be as automated as possible in order to reduce the overall production time for 3D printed parts. The rapid growth of such companies in the past five years, plus their increasing partnerships with established printer manufacturers, makes post-processing an interesting AM-related sector to monitor over the coming decade.

Software

As a digital manufacturing technique, 3D printing incorporates software at every step of the production process. To help expand AM's reach with end-users, the most popular focus of 3D printing software development is to make AM adoption easier for end-users. For example, companies like Xerox are developing software tools to advise end-users on which parts are most suitable for a switch to 3D printing; such software attempts to streamline the adoption process by removing the need for any engineering consulting to identify the best places for AM in an organization. At the design stage, software start-ups like nTopology and ParaMatters are producing tools to make it easier to create complex geometries for 3D printing, whilst others like Ansys produce simulation software to test the 3D printed parts' performance even prior to manufacture.

After printing, inspection, and quality assurance software compare 3D scans of the manufactured part to the original 3D model to identify deviations and defects, a critical step for parts used in highly regulated industries like aerospace and healthcare. Across the entire production process, workflow management software, like those offered by 3YOURMIND, AMFG, and AM-Flow, is needed to monitor the status of any given print project from ordering to final shipments; this becomes particularly essential when handling large volumes of prints, which many 3D printing companies aspire to do.

In other words, streamlined and easy-to-learn software is needed at every step of the 3D printing production process to enable increased adoption of AM. This need is recognized across the industry, particularly by investors; around USD$125M had been invested into software 3D printing-related companies in 2021. Additionally, two of the top 10 biggest fundraising rounds across the AM industry in 2021 were software companies - nTopology ($65M in Series D) and Oqton ($40M in Series A, pre-acquisition by 3D Systems). IDTechEx expects this investment trend to continue into 2022, as 21% of private funding going into AM companies in H1 2022 went into 3D software companies (up from 2021).

Services

Decades of industry following the same business strategy have exposed the inherent difficulties in selling printers to end-users. The most important barrier to entry is that customers need to find the budget for expensive printers and consumables that cost hundreds of thousands of dollars and hundreds of dollars per kilogram, respectively. Where purchasing a 3D printer is uneconomical or a hard sell for customers, service providers serve an important role in providing access to 3D printing without requiring end-users to have the technical know-how or pricey equipment and materials needed to operate AM printers.

Of note here is the increasing number of service providers with their own proprietary printing technology. Rather than selling the printers using their proprietary technology like traditional 3D printer manufacturers, they have chosen a different business strategy where they keep their proprietary printing technology in-house to produce parts for customers. In this way, in-house production companies using their own proprietary technology like 3DEO, Holo, and Bond3D are like vertically integrated OEMs. Through this business model, such companies circumvent many of the classic barriers to adoption that comes with commercializing a new printing technology. The growth coming from service providers like those mentioned is contributing to the expansion of a very important portion of the 3D printing ecosystem, which reduces the barriers to entry for end-users exploring AM.

Market Forecasts for Additive Manufacturing

IDTechEx's new "

3D Printing and Additive Manufacturing 2023-2033: Technology and Market Outlook" report carefully segments the market by eighty different forecast lines across seventeen different technology categories, four major material categories, and eight material subcategories. These hardware and material forecasts analyze future installations, hardware unit sales, hardware revenue, materials mass demand, and material revenue. Additionally, IDTechEx provides comprehensive technology benchmarking studies, examination and case studies of critical application areas, detailed discussion of auxiliary AM industry fields, and in-depth market and economic analysis. Finally, IDTechEx carefully dissects the positive and negative effects of the COVID-19 pandemic and subsequent supply chain disruptions on the 3D printing market. See the IDTechEx report for further information on this market including 125 interview-based profiles of market leaders and start-ups, technology comparison studies, business model analysis, and granular 10-year market forecasts .