- The U.S. serious delinquency rate reached its highest level since April 2014

- Metropolitan areas that lack strong job return led the nation in delinquencies in July

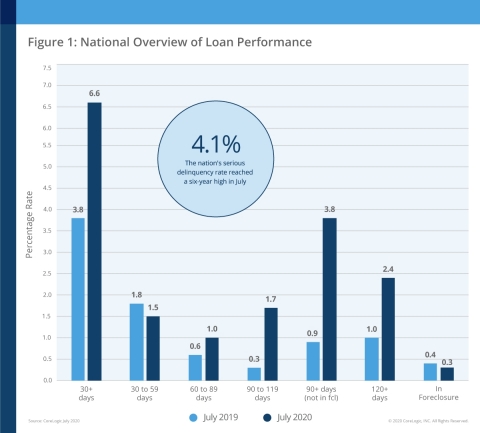

IRVINE, Calif. — (BUSINESS WIRE) — October 13, 2020 — CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today released its monthly Loan Performance Insights Report for July 2020. On a national level, 6.6% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure). This represents a 2.8-percentage point increase in the overall delinquency rate compared to July 2019, when it was 3.8%.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20201013005235/en/

CoreLogic National Overview of Mortgage Loan Performance, featuring July 2020 Data (Graphic: Business Wire)

To gain an accurate view of the mortgage market and loan performance health, CoreLogic examines all stages of delinquency, including the share that transitions from current to 30 days past due. In July 2020, the U.S. delinquency and transition rates, and their year-over-year changes, were as follows:

- Early-Stage Delinquencies (30 to 59 days past due): 1.5%, down from 1.8% in July 2019, and down from 4.2% in April when early-stage delinquencies spiked.

- Adverse Delinquency (60 to 89 days past due): 1%, up from 0.6% in July 2019, but down from 2.8% in May.

- Serious Delinquency (90 days or more past due, including loans in foreclosure): 4.1%, up from 1.3% in July 2019. This is the highest serious delinquency rate since April 2014.

- Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, down from 0.4% in July 2019. The July 2020 foreclosure rate is the lowest for any month in at least 21 years.

- Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.8%, unchanged from July 2019. The transition rate has slowed since April 2020, when it peaked at 3.4%.

Despite home values, measured by the CoreLogic Home Price Index, rising at an accelerated rate, unemployment levels in hard-hit areas remain stubbornly high, leaving some borrowers house-rich but cash poor. Despite the slow reopening of several sectors of the economy, recovery for other industries like entertainment, tourism, oil and gas have a more uncertain outlook for the remainder of 2020. With persistent job market and income instability, Americans continue to tap into savings to stay current on their home loans. But as savings run out, borrowers could be pushed further down the delinquency funnel.

“Many Americans, particularly millennials, are taking advantage of low rates to either purchase their first home or upgrade their living situations,” said Frank Martell, president and CEO of CoreLogic. “However, given the unsteadiness of the job market, many homeowners are beginning to feel the compounding pressures of unstable income and debt on personal savings buffers, creating heightened risk of falling behind on their mortgages."

“Four months into the pandemic, the 120-day delinquency rate for July spiked to 1.4%,” said Dr. Frank Nothaft, chief economist at CoreLogic. “This was the highest rate in more than 21 years and double the December 2009 Great Recession peak. The spike in delinquency was all the more stunning given the generational low of 0.1% in March.”

In July, all states logged annual increases in both overall and serious delinquency rates. COVID-19 hotspots were again impacted the most, with Nevada (up 5.2 percentage points), New Jersey (up 4.8 percentage points), Hawaii (up 4.7 percentage points), New York (up 4.6 percentage points) and Florida (up 4.4 percentage points) topping the list for overall delinquency gains.

Similarly, all U.S. metro areas logged at least a small increase in serious delinquency rates in July. Odessa, Texas — which has been hard hit by job loss in the oil and gas industry — experienced the largest annual increase, up 7.5 percentage points. Other metro areas with significant serious delinquency increases included Laredo, Texas (up 6.6 percentage points); Miami (up 6.4 percentage points); McAllen, Texas (up 6.2 percentage points) and Kahului, Hawaii (up 5.9 percentage points).

With industries like oil and gas projected to leave millions of jobs unrestored throughout the remainder of the year, we may expect to see continued increases in mortgage delinquencies.

The next CoreLogic Loan Performance Insights Report will be released on November 10, 2020, featuring data for August 2020. For ongoing housing trends and data, visit the CoreLogic Insights Blog: www.corelogic.com/insights.

Methodology

The data in The CoreLogic LPI report represents foreclosure and delinquency activity reported through July 2020. The data in this report accounts for only first liens against a property and does not include secondary liens. The delinquency, transition and foreclosure rates are measured only against homes that have an outstanding mortgage. Homes without mortgage liens are not subject to foreclosure and are, therefore, excluded from the analysis. CoreLogic has approximately 75% coverage of U.S. foreclosure data.

Source: CoreLogic

The data provided is for use only by the primary recipient or the primary recipient's publication or broadcast. This data may not be re-sold, republished or licensed to any other source, including publications and sources owned by the primary recipient's parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact Valerie Sheets at newsmedia@corelogic.com. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic (NYSE: CLGX), the leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, buy and protect their homes. For more information, please visit www.corelogic.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries. All other trademarks are the property of their respective owners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20201013005235/en/

Contact:

Valerie Sheets

CoreLogic

newsmedia@corelogic.com