- Home-price growth projected to slow to 4.8 percent by November 2019

- November marked the eighth consecutive month of slowing annual HPI growth

- Homeowner perception of home value may set up 2019 as a buyers’ market

- North Dakota was the only state to show a year-over-year decline in prices this month, while Idaho and Nevada showed double-digit growth

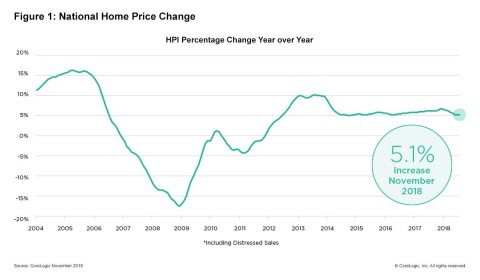

IRVINE, Calif. — (BUSINESS WIRE) — January 2, 2019 — CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for November 2018, which shows home prices rose both year over year and month over month. Home prices increased nationally by 5.1 percent year over year from November 2017. On a month-over-month basis, prices increased by 0.4 percent in November 2018. ( October 2018 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190102005113/en/

CoreLogic National Home Price Change; November 2018. (Graphic: Business Wire)

Looking ahead, the CoreLogic HPI Forecast indicates home prices will increase by 4.8 percent on a year-over-year basis from November 2018 to November 2019. On a month-over-month basis, home prices are expected to decrease by 0.8 percent from November to December 2018. The CoreLogic HPI Forecast is a projection of home prices calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“The rise in mortgage rates has dampened buyer demand and slowed home-price growth,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Interest rates for new 30-year fixed-rate loans averaged 4.9 percent during November, the highest monthly average since February 2011. These higher rates and home prices have reduced buyer affordability. Home sellers are responding by lowering their asking price, which is reflected in the slowing growth of the CoreLogic Home Price Index.”

According to the CoreLogic Market Condition Indicators (MCI), an analysis of housing values in the country’s 100 largest metropolitan areas based on housing stock, 35 percent of metropolitan areas have an overvalued housing market as of November 2018. The MCI analysis categorizes home prices in individual markets as undervalued, at value or overvalued, by comparing home prices to their long-run, sustainable levels, which are supported by local market fundamentals (such as disposable income). Additionally, as of November 2018, 27 percent of the top 100 metropolitan areas were undervalued, and 38 percent were at value.

When looking at only the top 50 markets based on housing stock, 44 percent were overvalued, 18 percent were undervalued and 38 percent were at value. The MCI analysis defines an overvalued housing market as one in which home prices are at least 10 percent above the long-term, sustainable level. An undervalued housing market is one in which home prices are at least 10 percent below the sustainable level.

In 2018, CoreLogic together with RTi Research of Norwalk, Connecticut, conducted an extensive survey measuring consumer-housing sentiment, combining consumer and property insights. The study assessed attitudes toward homeownership and the driving force behind the decision to buy or rent a home. When homeowners were asked why they felt their home was increasing in value, they cited desirable location and improving local and national economies. As the country enters a new year, the state of these economic conditions will continue to impact attitudes toward homeownership and perceived property values.

“A strong economy helps homeowners feel confident about the value of their property,” said Frank Martell, president and CEO of CoreLogic. “If recent declines in the stock market shakes consumer confidence in the national economy, we may see homeowners’ perception of home value change and a subsequent buyers’ market emerge in 2019.”

The next CoreLogic HPI press release, featuring December 2018 data, will be issued on Tuesday, February 5, 2019 at 8:00 a.m. ET.

Methodology

The CoreLogic HPI™ is built on

industry-leading public record, servicing and securities real-estate

databases and incorporates more than 40 years of repeat-sales

transactions for analyzing home price trends. Generally released on the

first Tuesday of each month with an average five-week lag, the CoreLogic

HPI is designed to provide an early indication of home price trends by

market segment and for the “Single-Family Combined” tier, representing

the most comprehensive set of properties, including all sales for

single-family attached and single-family detached properties. The

indices are fully revised with each release and employ techniques to

signal turning points sooner. The CoreLogic HPI provides measures for

multiple market segments, referred to as tiers, based on property type,

price, time between sales, loan type (conforming vs. non-conforming) and

distressed sales. Broad national coverage is available from the national

level down to ZIP Code, including non-disclosure states.