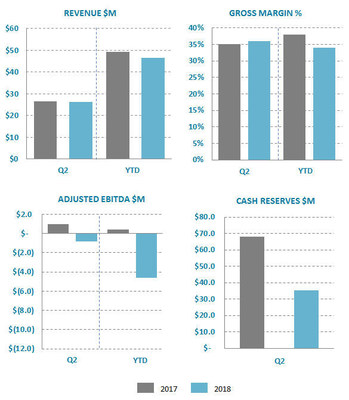

Randy MacEwen, President and CEO said, "Financial results and new contract bookings for Q2 and year-to-date are consistent with the type of first half to the year we had expected. We delivered Q2 revenue of $26.4 million, gross margin of 36% and Adjusted EBITDA of ($0.8) million. We are excited to have ended the quarter with a record Order Backlog of $283.3 million."

Mr. MacEwen also noted, "The global megatrend of electrification of propulsion systems is accelerating. This megatrend is driving growing interest in fuel cell electric vehicles, or FCEVs, for transportation applications where long range, rapid refueling, heavy payload and route flexibility are customer requirements. Interest and customer engagement continues to build in heavy-duty motive applications, including bus, truck, rail and marine, along with automotive, material handling and unmanned vehicle applications. During Q2, we were particularly excited with the long-term extension, through to August 2022, of our HyMotion program with AUDI AG, in support of its automotive fuel cell strategy and deployment plans."

Mr. MacEwen concluded, "As we look out to 2019 and beyond, and to our pathway to profitability, we expect strong growth in FCEV demonstration programs and commercial scaling in certain heavy and medium duty applications in China, Europe and the United States. With continued investment in technology, products, customer engagement and our brand, we see Ballard having a leading position in these large and growing addressable markets."

Q2 2018 Financial Highlights

(all comparisons are to Q2 2017 unless otherwise noted)

- Revenue was $26.4 million, flat on a year-over-year basis, reflecting growth in Power Products, offset by a decline in Technology Solutions due primarily to the strong contribution in Q2 2017 from one-time technology transfer and related agreements with the company's joint venture in China.

- The Power Products platform generated revenue of $17.8 million, an increase of 18%:

- Heavy Duty Motive revenue was $13.3 million, an increase of 9% related primarily to increased product shipments to China, Europe and North America;

- The Portable Power business generated $2.4 million, an increase of 170% due to Power Manager product orders from military customers;

- Material Handling revenue was $1.7 million, a decline of 13% primarily due to the continued in-housing of stack supply by a key customer, combined with lower average selling price resulting from a shift in product mix; and

- Telecom Backup Power revenue was $0.4 million, an increase of $0.3 million resulting primarily from sales in Europe for a variety of backup power installations.

- The Technology Solutions platform generated revenue of $8.6 million, a decrease of 24% due primarily to the strong contribution in Q2 2017 from one-time technology transfer and related agreements with the company's joint venture in China, partially offset by increases in amounts earned from other programs.

- Gross margin was 36%, a 1-point improvement reflecting revenue mix.

- Cash operating costs2 were $10.5 million, an increase of 24% primarily attributable to higher research and product development expenses.

- Adjusted EBITDA2 was ($0.8) million in Q2, a decline of 180% or $1.8 million, primarily driven by higher operating costs.

- Net loss was ($4.3) million, a decline of $3.1 million.

- Net loss per share was ($0.02) compared to ($0.01) in Q2 2017.

- Adjusted net loss2 was ($4.3) million, a decline of $3.9 million.

- Adjusted net loss per share2 was ($0.02) compared to ($0.00) in Q2 2017.

- Cash used by operating activities was ($16.9) million, a decline of $18.7 million reflecting cash operating loss of ($1.6) million and use in working capital of ($15.3) million, largely associated with an increase in accounts receivable and increased inventory to support expected deliveries in the second half of this year.

- Cash reserves were $35.2 million at June 30, a decrease of 48% from the end of Q2 2017 and a decrease of 33% from the end of the prior quarter, primarily due to an increase in working capital in the quarter.

- During Q2 Ballard received $87.7 million in new orders and also delivered orders valued at $26.4 million, thereby significantly increasing Order Backlog from $222.0 million in the prior quarter, to $283.3 million at end-Q2. The 12-month Order Book also increased from $89.0 million in the prior quarter, to $96.0 million at end-Q2.

Q2 2018 Highlights

Bus

- Received a purchase order from Van Hool NV for 40 FCveloCity®-HD modules to power buses planned for deployment in Germany under the Joint Initiative for hydrogen Vehicles across Europe (JIVE) funding program.

- Subsequent to the quarter, announced that El Dorado National's 40-foot Axess fuel cell bus, powered by Ballard's FCveloCity®-HD module, successfully completed testing at The Altoona Bus Research and Testing Center in Pennsylvania under a program established by the Federal Transit Administration (FTA), making them ready for large-scale deployments under FTA funding.

Marine

- Signed a Memorandum of Understanding with ABB to undertake collaboration activities toward the development of megawatt (MW) scale proton exchange membrane fuel cell power systems for the marine market, with an initial focus on the cruise ship segment.

- Ballard Power Systems Europe became a member of a consortium that has received funding to design and build HySeas III, the world's first sea-going renewables-powered car and passenger ferry. Operation of the ferry is planned in the Orkney Archipelago, located off the northeastern coast of Scotland.

- Two FCveloCity®-MD modules were successfully integrated and tested in a hybrid marine application by a consortium including Yanmar Co. Ltd. as part of a program to develop safety guidelines for hydrogen fuel cell-powered boats operating in Japan's restricted coastal waters. The modules were previously provided to Yanmar by Toyota Tsusho Corporation under a Distribution Agreement with Ballard.