- Price Appreciation Outstripping Income Growth in Many Markets

- Many Markets Still Lack Adequate Inventory

- Tight Inventory Impacting Rental Markets

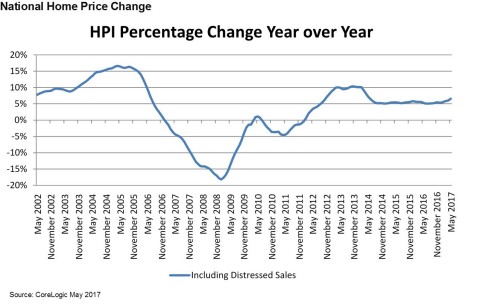

IRVINE, Calif. — (BUSINESS WIRE) — July 5, 2017 — CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today released its CoreLogic Home Price Index (HPI™) and HPI Forecast™ for May 2017 which shows home prices are up strongly both year over year and month over month. Home prices nationally increased year over year by 6.6 percent from May 2016 to May 2017, and on a month-over-month basis, home prices increased by 1.2 percent in May 2017 compared with April 2017,* according to the CoreLogic HPI.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170705005007/en/

CoreLogic National Home Price Change: May 2017 (Graphic: Business Wire)

Looking ahead, the CoreLogic HPI Forecast indicates that home prices will increase by 5.3 percent on a year-over-year basis from May 2017 to May 2018, and on a month-over-month basis home prices are expected to increase by 0.9 percent from May 2017 to June 2017. The CoreLogic HPI Forecast is a projection of home prices using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“The market remained robust with home sales and prices continuing to increase steadily in May,” said Dr. Frank Nothaft, chief economist for CoreLogic. “While the market is consistently generating home price growth, sales activity is being hindered by a lack of inventory across many markets. This tight inventory is also impacting the rental market where overall single-family rent inflation was 3.1 percent on a year-over-year basis in May of this year compared with May of last year. Rents in the affordable single-family rental segment (defined as properties with rents less than 75 percent of the regional median rent) increased 4.7 percent over the same time, well above the pace of overall inflation.”

“For current homeowners, the strong run-up in prices has boosted home equity and, in some cases, spending,” said Frank Martell, president and CEO of CoreLogic. “For renters and potential first-time homebuyers, it is not such a pretty picture. With price appreciation and rental inflation outstripping income growth, affordability is destined to become a bigger issue in most markets.”

Methodology

The CoreLogic HPI™ is built on industry-leading public record, servicing and securities real-estate databases and incorporates more than 40 years of repeat-sales transactions for analyzing home price trends. Generally released on the first Tuesday of each month with an average five-week lag, the CoreLogic HPI is designed to provide an early indication of home price trends by market segment and for the “Single-Family Combined” tier representing the most comprehensive set of properties, including all sales for single-family attached and single-family detached properties. The indexes are fully revised with each release and employ techniques to signal turning points sooner. The CoreLogic HPI provides measures for multiple market segments, referred to as tiers, based on property type, price, time between sales, loan type (conforming vs. non-conforming) and distressed sales. Broad national coverage is available from the national level down to ZIP Code, including non-disclosure states.

CoreLogic HPI Forecasts™ are based on a two-stage, error-correction econometric model that combines the equilibrium home price—as a function of real disposable income per capita—with short-run fluctuations caused by market momentum, mean-reversion, and exogenous economic shocks like changes in the unemployment rate. With a 30-year forecast horizon, CoreLogic HPI Forecasts project CoreLogic HPI levels for two tiers—“Single-Family Combined” (both attached and detached) and “Single-Family Combined Excluding Distressed Sales.” As a companion to the CoreLogic HPI Forecasts, Stress-Testing Scenarios align with Comprehensive Capital Analysis and Review (CCAR) national scenarios to project five years of home prices under baseline, adverse and severely adverse scenarios at state, CBSA and ZIP Code levels. The forecast accuracy represents a 95-percent statistical confidence interval with a +/- 2.0 percent margin of error for the index.

Source: CoreLogic

The data provided are for use only by the primary recipient or the

primary recipient's publication or broadcast. This data may not be

resold, republished or licensed to any other source, including

publications and sources owned by the primary recipient’s parent company

without prior written permission from CoreLogic. Any CoreLogic data used

for publication or broadcast, in whole or in part, must be sourced as

coming from CoreLogic, a data and analytics company. For use with

broadcast or web content, the citation must directly accompany first

reference of the data. If the data are illustrated with maps, charts,

graphs or other visual elements, the CoreLogic logo must be included on

screen or website. For questions, analysis or interpretation of the

data, contact Lori Guyton at

lguyton@cvic.com

or Bill Campbell at

bill@campbelllewis.com .

Data provided may not be modified without the prior written permission

of CoreLogic. Do not use the data in any unlawful manner. The data are

compiled from public records, contributory databases and proprietary

analytics, and its accuracy is dependent upon these sources.